The Tax Cuts and Jobs Act which becomes effective in the 2018 tax year, translates into a potential 20% tax reduction for qualified business profit from pass-through entities such as s-corporations, limited liability companies, partnerships, and sole …

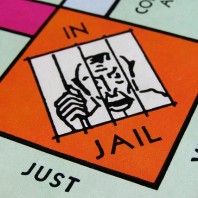

Philadelphia tax credits are like a get out of jail free card. They equate to getting a pass on the some of the tax you owe. Unlike tax deductions which are subtracted from taxable …

Residents of the city of “Brotherly Love” are used to paying a lot of taxes. This year is no different. As the 2017 tax year rolls to an end, this is what you need to …

This post briefly outlines the best tax breaks available to small business owners who are filing taxes for the 2017 tax year. Fixed Assets Deduction For 2017, the IRS will allow business owners to deduct …